Risk Management

The management of technical and information technology risk is a core operational requirement for leading enterprises and organizations. Why? Because without an informed and adaptive risk management strategy, your ability to achieve key goals and objectives is in jeopardy.

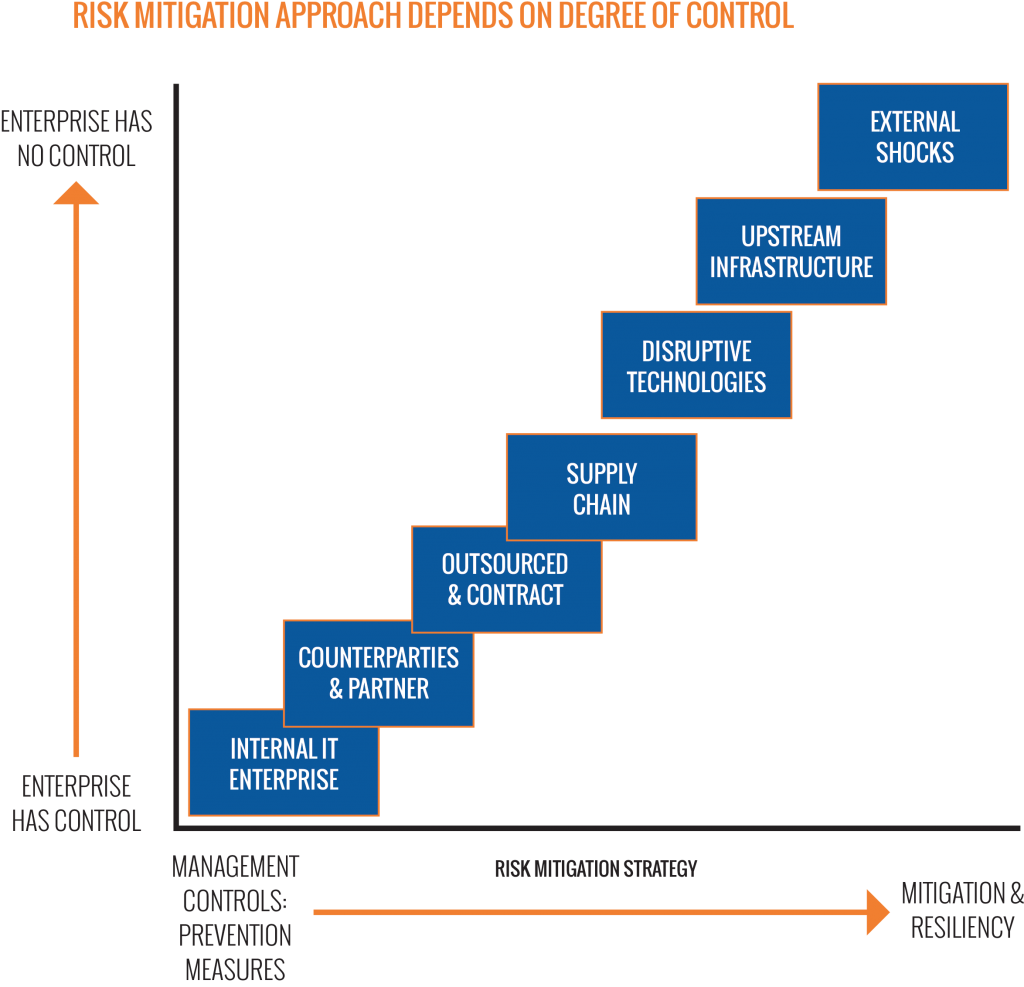

At JAS Global Advisors, we know how to mitigate the risk to your organization. We are experts in designing and implementing preventive technologies, protocols and processes to address seven major sources of risk that reside inside and outside your company’s borders, including:

- Internal Enterprise: the cumulative set of an organization’s (mostly internal) IT

- Partners: dependence on or direct interconnection (usually non-contractual) with an outside organization

- Outsourced and Contracted Parties: external suppliers of services, e.g., HR, legal or IT and cloud services.

- Supply Chain: for the IT sector and cyber risks to traditional supply chains and logistics

- Disruptive Technologies: unanticipated effects of new or disruptive technologies

- Upstream Infrastructure: disruptions to infrastructure relied on by economies and societies, especially electricity, finance and telecommunications

- External Shocks: incidents outside the system as a whole, outside of the control of most organizations including conflicts, grand-scale malfeasance and natural disasters, and the best practices, risks, and requirements of compliance with the evolving influence of regulators and governments on your IT environment.

Since threats to sources of risk can originate from a range of intentional and unintentional causes (errors of omission, malfeasance, cybercrime, etc.), it’s critical to develop a comprehensive risk management plan that incorporates a diverse mix of strategies. As JAS, we routinely deliver risk management strategies that focus on the entire framework of threats to your organization:

- Direct management and risk prevention where the enterprise has total control (i.e., internal enterprise risk)

- Mitigation and resilience where the enterprise lacks control (i.e., upstream infrastructure and external shock risk)

- Combined sources of risk where the enterprise has limited control (i.e., outsourcing and supply chain risk)

Managing Internal and External Risk

Risk mitigation strategies must match the degree of control within the enterprise. Where the enterprise has significant control, the strategy should call for prevention measures; where there is limited control, mitigation and resiliency are the keys to the reduction of risk.

Aggregation of risks

Due to the interaction of organizations and technologies, the effects of risks can combine and multiply in a way that exceeds the sum of the parts, presenting serious threats to the enterprise. It is well accepted that risk planning must take into account the global aggregation of risks.

Operational, Brand and Reputational Risk

The effects of poor risk management not only damage immediate operations, but also pose lasting threats to reputation, brand value and long-term market capitalization. By developing and implementing robust risk management strategies, JAS helps enterprises avoid the exponential costs that are often associated with security attacks.

Risk Governance

JAS can also work with you to manage risk by improving your organization’s risk governance:

- Establishing board-level risk oversight and governance

- Designing and implementing a corporate risk-management function

- Establishing specialized risk management practices that address issues of security, critical infrastructure protection, and human safety

- Managing insider risks